Falling gas prices due to rising U.S. shale oil production

IMAGE / Dylan Brewer

The price of gas is below $3. This decrease was fueled by an increased oil supply.

For the 41.3 million Americans that AAA estimated traveled by car for Thanksgiving last week, the price of one commodity was noticeably different: gas.

Down 43 cents from last Thanksgiving, the price of gas is at a five year low.

To drivers like Senior Chance Lo’Ree, the break in gas prices is a much-welcomed relief.

“I love it,” Lo’Ree said. “They’re low enough to where I can afford it.”

When the price of gas goes up, explanations about possible reasons for the jump are abundant. When the price takes a plunge, however, the average consumer is thankful.

Lo’Ree said, “I’m just like, ‘Oh, hey, gas is like $2.60. Go get some.’”

Yet, the story behind the price drop is particularly notable.

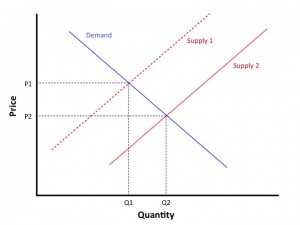

American shale oil is being produced at an all-time high. This has produced a significant increase in supply, while demand remains relatively the same.

The result, as high school economics teaches, is a rightward shift in the supply curve, resulting in a decrease in price.

The Organization of the Petroleum Exporting Countries had a chance last week to end the price free fall by decreasing its production, which would shift the supply curve back to the left.

But OPEC chose to maintain its production, thus keeping prices low for now.

Why would OPEC choose to keep the price low, when a single decision could drive their profits back up?

Mr. Austin Brewer, economics student at the University of Michigan, said it is a strategy to maintain control of the market.

Brewer said, “In a market dominated by a single supplier, it is not uncommon for them to use their market share to their advantage.”

Brewer said OPEC could decide to keep prices low – possibly to the point of taking a loss – in order to make it unprofitable for smaller producers.

“Once the other producers exit, OPEC can exercise monopoly power again, and increase prices to compensate for the temporary losses they experienced,” Brewer said.

When the quantity supplied increases, the price decreases. The increase in oil has led to lower prices at the pump.

Brewer said that although this agreement was made as an organization, it is important to keep an eye on the countries that compose the cartel.

“It is very difficult to align incentives of multiple countries to produce only certain amounts of oil,” Brewer said. “Game theory would tell us that OPEC is fundamentally unstable.”

In fact, this decision is putting strain on members of the cartel.

Iran is perhaps the most noticeably hurt. Already struggling because of the oil exporting limit put on the country because of US nuclear sanctions, this drop in the price of oil further cuts into the country’s revenue.

Iran is not alone though. Venezuela and Nigeria need oil prices of about $100 a barrel to fund their national budgets.

For now, there will be a welcome relief at the pump. Only time will tell whether this relief will last, or if the tactics of OPEC will regain some of their lost control of the market, driving gas prices back up.

Class: Senior

Clubs: National Honor Society, Future Problem Solving, Robotics, Mathletics

Athletics: Tennis

Hobbies:Technology, Politics, Religion,...