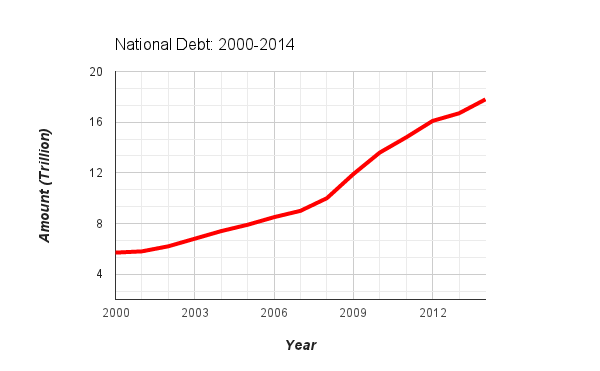

National debt reaches $18 trillion

IMAGE / Katie Valley

SOURCE/TreasuryDirect

National debt for the United States reached a high of $18 trillion, as of Friday, Nov. 28.

The recession, which began in 2008, perpetuated the rise of national debt. It brought forth more than $8 trillion of debt in just six years. This is 33 percent higher than the $6 trillion acquired in the six years before.

The government, however, is not doing much to slow down the increasing debt.

The United States has a cumulative student loan debt of over $1 trillion, which accounts for at least five percent of the national debt. This would warrant increased concern over the national debt in students.

Mr. Michael Whalen, economics teacher, is concerned about the debt this country has acquired.

“I think everyone should be concerned about the debt in this country,” Whalen said.

Whalen went on to say that people should be concerned not only about the national debt but “their own debt and the debt of their loved ones.”

Solving the debt crisis could mean the rise of a new economic era.

Konstantinos Zaravelis, junior, said that the United States’ national debt is “relevant to the USA’s ability to pay.”

“The national debt will affect interest rates and increase the price on consumer goods,” Zaravelis said. “It is written in our constitution that the United States cannot default on its national debt.”

Section Four of the 14th Amendment in the Constitution of the United States says that “[T]he validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.”

The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.

— 14th Ammendment, Section Four

This means that the government is not allowed to default on its debt. By not defaulting on its national debt, the United States could eventually pay back its debt, or at least the debt mentioned in upcoming bills passed by Congress.

Zaravelis believes the federal debt will drop.

“The U.S. debt will go down as soon as the economy recovers and more tax dollars start flowing into the federal government,” Zaravelis said.

There are still many people wondering why America still employs deficit spending, or spending more than what is collected in taxes. At the rate debt is being acquired, the national debt could be up to $20 trillion in a few years.

The average debt of the American citizen, according to usdebtclock.org, is $56,227. If the national debt continues to increase, the average debt of each citizen will increase as well.

Santino Guerra, junior and DECA member, thinks that the amount of debt the United States has acquired is outrageous.

“It’s not a good feeling to know that our nation is in debt over $17 trillion,” Guerra said. “As a nation, we need to come together and find a way to help reduce this large number.”

Class: Senior

Extracurricular Activities: Drama Club, Thespian Society, National Honor Society

Sports: Soccer

Hobbies/Interests: Reading, Writing,...